The Clifton Private Finance Mortgage Pulse Report 2024 has unveiled eye-opening findings on the UK public’s outlook towards interest rates, mortgage affordability, property price trends, and the ongoing housing crisis debate.

Gathered from over 350 responses via form submissions on the Clifton Private Finance website from November to January, a period when the site witnesses high traffic from individuals seeking property and finance advice, the report sheds light on consumer sentiments for the year ahead.

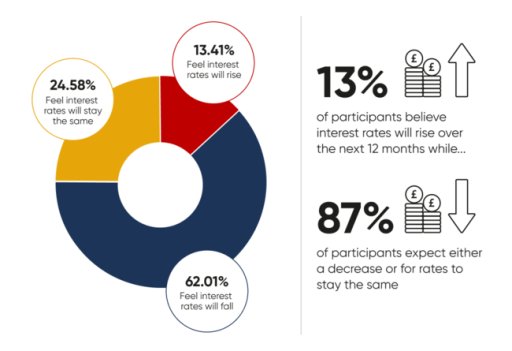

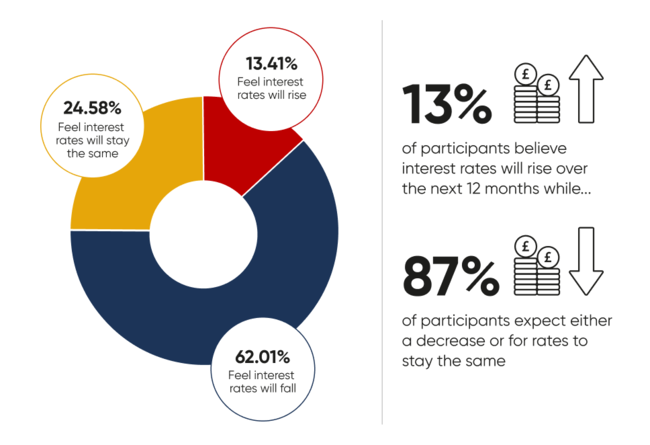

The report’s notable discoveries include that a vast majority, exceeding 85%, of respondents do not foresee a rise in interest rates in 2024. Additionally, a third express concerns over their ability to meet mortgage repayments, while three-quarters are sceptical about any increase in property prices within the year. Furthermore, over 60% acknowledge the existence of a housing crisis in the UK.

A mere 13% anticipate an uptick in interest rates over the forthcoming year, with 87% predicting rates to either decline or remain unchanged.

This insight is particularly relevant in the context of the ongoing debate between choosing fixed-rate or tracker mortgages, especially for first-time homebuyers and those considering remortgaging soon.

Experts from Clifton Private Finance, including mortgage brokers, have also weighed in on the findings, reflecting on their daily observations of the mortgage and property market dynamics.

Carly Cheeseman, Head of International at Clifton Private Finance, commented, “Firstly, interest rates have already significantly improved over the last 8-12 weeks, which is good news for borrowers but I’d expect the base rate to stay the same until around springtime next year, at which point we may see a reduction.”

George Abouzolof, a Senior Finance Broker, shared, “Yes, I think interest rates will go down over the next 12 months. The best place to look is at the swap rates between banks – these are the rates at which banks borrow money from each other. If swap rates go down, clients’ rates tend to follow – and that’s what we’re seeing at the moment.”

The full insights can be explored in the report available at www.cliftonpf.co.uk/bridging-loans/mortgage-pulse-report-2024/.