Ruhul Shamsuddin, the founder of Lordsons Estate Agents, shares his insights for the 2024 rental market. Drawing from over a decade of experience, he predicts a year of challenges tempered with stabilising factors.

- Landlords at a Crossroads: According to Lordsons, 25% of landlords are considering selling their properties by August 2024. Factors like rising mortgage rates and a shift in capital gains tax allowance are influencing this trend. Ruhul points out the significant impact of the reduced capital gains tax allowance, effective from April 2024.

- Fluctuating Rental Costs: While rental prices reached their highest in August 2023, Ruhul predicts a continued rise in 2024, albeit at a slowing pace in some regions, potentially easing the burden on tenants.

- The Political Factor: The forthcoming General Election will crucially impact the rental market. Ruhul underscores the importance of party policies, from the Conservatives’ rental reforms to Labour’s stance on Section 21 evictions.

- Energy Efficiency and Costs: Despite scrapped plans to raise energy efficiency standards, Ruhul stresses that rising energy bills remain a key issue in the rental sector.

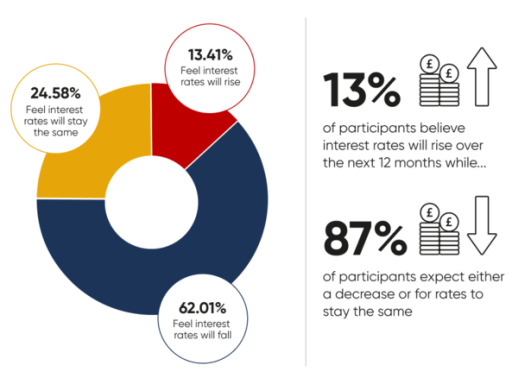

- Tax Increases and Stabilising Interest Rates: Ruhul anticipates higher taxes for landlords in 2024 but also predicts a stabilisation in interest rates, offering a glimmer of hope.

- Refinement in Licensing Schemes: The continuation and expansion of selective licensing schemes from 2023 into 2024 signal a dedicated effort to address housing quality and community concerns.

Ruhul Shamsuddin concludes that 2024 will be a year of dynamic changes in the rental market, advising stakeholders to remain informed and prepared for upcoming legislative shifts.