In the vast world of online trading platforms, Azura Capital emerges as a prominent player, offering traders a comprehensive suite of features and services. With a commitment to delivering a seamless trading experience, Azura Capital has garnered a reputation for providing a user-friendly platform, diverse market options, cutting-edge technology, and dedicated customer support. This Azura Capital review aims to analyze the broker’s most notable offerings, including the trading conditions and account options.

Azura Capital Review: About the Broker

General Information

| Broker Name | Azura Capital |

| Broker Type | Forex, Cryptocurrencies, Stocks, Indices, Commodities, NFTs |

| Country | Australia |

| Address | 478 George St, Sydney NSW |

| Broker Status | Active |

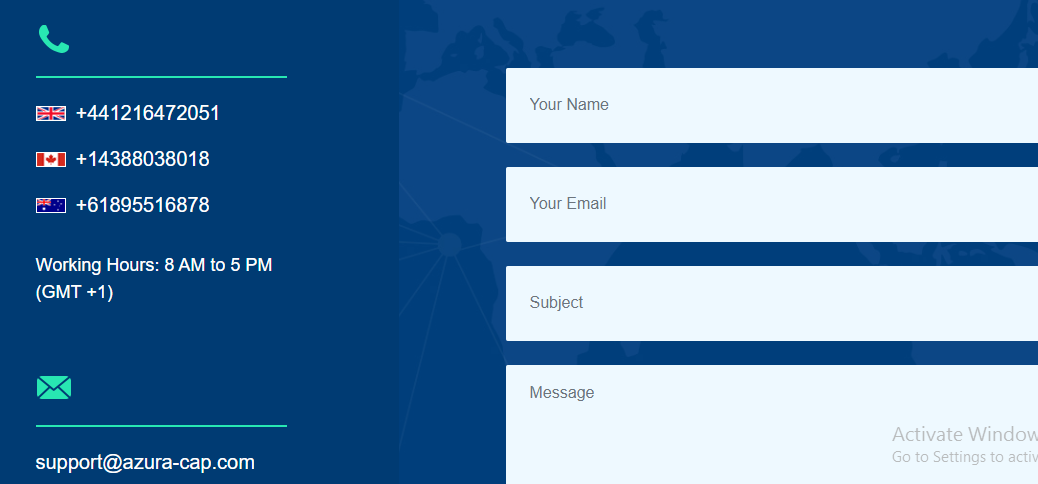

Customer Service

| Phone numbers | UK: +441216472051

Canada: +14388038018 Australia: +61895516878 |

| support@azura-cap.com | |

| Language | English |

| Availability | 24/5 |

| Working hours | 8 AM to 5 PM |

Azura Capital’s Innovative Trading Platform

Azura Capital sets itself apart by offering traders a cutting-edge trading platform that is both seamless and intuitive. This platform is meticulously designed to provide a user-friendly experience while equipping traders with advanced tools and features that give them a competitive edge in the financial markets.

With Azura Capital’s trading platform, traders can expect a seamless and hassle-free experience. The intuitive interface ensures that navigating through various sections, executing trades, and accessing market data is effortless. Whether you are a novice trader or an experienced investor, the platform’s user-friendly design caters to traders of all levels, enabling them to easily trade.

To empower traders with customization options, Azura Capital provides an array of personalized tools. This level of unmatched customization allows traders to tailor their trading experience to their specific needs. By utilizing these personalized tools, traders can craft strategies that align with their investment goals and risk tolerance.

In addition to its desktop trading platform, Azura Capital goes the extra mile by offering mobile trading capabilities. This means that traders can access the platform and manage their trades anytime, anywhere, directly from their mobile devices.

Azura Capital Review: Exploring the Broker’s Diverse Market Offerings

Azura Capital takes pride in providing traders with an extensive range of markets, catering to their diverse trading preferences and investment strategies.

In the world of cryptocurrencies, Azura Capital allows traders to immerse themselves in the digital asset market. From well-established cryptocurrencies like Bitcoin and Ethereum to emerging altcoins and innovative projects, traders can benefit from this exciting market’s high volatility and growth potential.

When it comes to stocks, Azura Capital unlocks global opportunities for traders. Blue-chip stocks from renowned industries such as technology, finance, healthcare, and more are readily accessible. Additionally, traders can immerse themselves in the vast and highly liquid foreign exchange market. They can trade major currency pairs such as USD, EUR, GBP, and more.

Azura Capital provides access to a wide range of renowned global indices. Traders can participate in leading stock markets worldwide by trading indices such as the S&P 500, FTSE 100, and Nikkei 225. The broker also opens doors to the commodities market, allowing traders to explore energy resources like oil and natural gas, agricultural products such as grains and coffee, precious metals like gold and silver, and even forestry products.

Flexible Account Types for All Traders with Azura Capital Review

Azura Capital understands that every trader has unique trading needs and aspirations. To cater to this diversity, it offers a range of account types, ensuring that each trader can find an option that aligns with their requirements. With five distinct account levels available, Azura Capital provides a variety of features and benefits to enhance the trading experience.

The Basic Account

The Basic account is an excellent choice for traders starting their journey. With a minimum deposit of €1,500, this account grants access to a comprehensive range of customer services, including 24/7 support. Traders also enjoy professional charting tools and a 7-day trial of a managed account, allowing them to explore the platform and its capabilities.

The Silver Account

For traders seeking a more personalized experience, the Silver account offers added benefits. With a higher deposit requirement of €25,000, traders gain access to a personal analyst who provides guidance and insights. They also receive a personal introduction session and monthly sessions with an analyst, further enhancing their trading knowledge and strategies. The Silver account provides 24/7 customer support, a 30-day trial of a managed account, and additional perks such as free monthly withdrawals and bonus opportunities.

The Gold Account

The Gold account takes personalization a step further, offering enhanced services to traders with a deposit of €50,000. Along with all the features of the Silver account, traders in the Gold tier benefit from weekly sessions with an analyst, further strengthening their trading strategies. They receive a higher bonus potential, free weekly withdrawals, and a membership to the managed account, granting them access to even more comprehensive trading resources.

The Platinum Account

The Platinum account offers extensive benefits and privileges for seasoned traders with a higher level of investment. With a minimum deposit of €150,000, traders receive all the features of the Gold account and more. They enjoy the added advantage of direct communication with the dealing department via WhatsApp, ensuring efficient and timely trading execution. Platinum account holders also gain access to Platinum Market, where faster trade execution is possible. With increased leverage to 1:100, traders can amplify their trading potential significantly.

The VIP Account

Azura Capital also provides a unique opportunity for traders to discuss tailored account options directly with their account manager. The VIP account offers a fully managed account, eliminating trading fees, swap charges, and withdrawal fees. Traders in this account type receive exclusive benefits, including WhatsApp dealing access, regular communication with an analyst, fully protected trades, and market research reports tailored to their needs.

In conclusion, Azura Capital offers a range of account types to accommodate traders of various levels and preferences. From the Basic account designed for beginners to the Platinum account for experienced traders, each account level provides a distinctive set of features and benefits. Traders can choose an account that suits their trading goals, giving them the flexibility and resources they need to succeed in the financial markets.

Azura Capital Review: Empowering Traders through Educational Resources

Azura Capital recognizes the importance of continuous learning and development for traders of all levels. The broker offers comprehensive educational resources to support their clients’ growth and knowledge. Whether you are a beginner looking to grasp the basics or an experienced trader seeking to refine your skills, the educational resources are designed to enhance your trading journey.

Webinars are one of the valuable educational tools provided by Azura Capital. These live online seminars cover various trading topics, strategies, and market analysis.

E-books are another resource offered by Azura Capital to enhance traders’ education. These digital books cover a wide range of topics, from trading fundamentals to advanced strategies. Whether you prefer to learn at your own pace or delve deeper into specific trading concepts, e-books provide a comprehensive resource.

Azura Capital also provides trading guides that serve as practical resources for traders. These guides offer step-by-step instructions on various trading processes, such as account setup, platform navigation, order placement, risk management, and more.

The broker understands that education is a crucial aspect of trading, and by providing educational resources, it demonstrates the commitment to its clients’ growth and development.

Dedicated Customer Support for Your Peace of Mind

At Azura Capital, delivering outstanding customer support is a top priority. The broker understands that reliable and efficient assistance is crucial for traders, especially when navigating the dynamic world of online trading. With Azura Capital’s dedicated customer support, you can rest assured that help is always just a call or email away.

The broker’s customer support team consists of knowledgeable professionals who are ready to address your inquiries and provide prompt solutions. Whether you have questions regarding account setup, platform functionality, or general trading queries, the support team is committed to meeting your needs. They strive to deliver exceptional service, offering guidance and assistance throughout your trading journey.

Azura Capital offers multiple channels for contacting customer support. You can reach out to them via phone, allowing for direct and immediate communication. Alternatively, you can choose to write an email, and the team will respond to your queries in a timely manner. With these options, you can select the most convenient method for you, ensuring a seamless and efficient support experience.

Azura Capital Review: Conclusion

In conclusion, Azura Capital is committed to providing traders with a comprehensive and user-friendly trading experience. With a wide range of markets available, including cryptocurrencies, stocks, forex, and more, the broker offers ample opportunities for traders to diversify their portfolios and capitalize on global market trends.

Furthermore, the availability of educational resources, such as webinars, e-books, and trading guides, demonstrates Azura Capital’s dedication to supporting traders’ learning and development. The broker’s customer support team ensures that assistance is readily available whenever needed, providing prompt solutions and guidance.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading experience. The information provided in this article may need to be more accurate and up-to-date. Any trading or financial decision you make is your sole responsibility, and you must not rely on any information provided here. We do not provide any warranties regarding the information on this website and are not responsible for any losses or damages incurred from trading or investing.