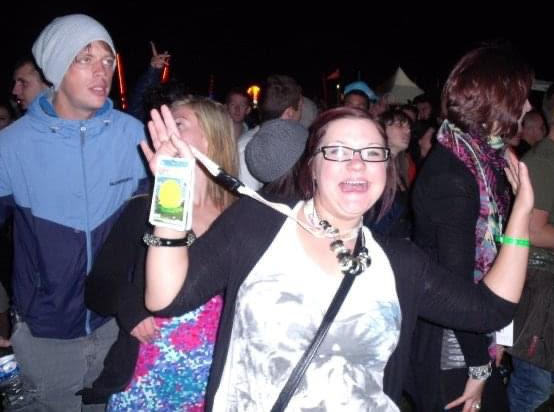

Natalie Greenhough, once a confessed frivolous spender, has shared her cautionary tale of how she spiralled into debt using buy now, pay later schemes and how she managed to break free from the cycle.

In her younger years, Natalie often leaned on her parents for financial support to fuel her spending habits. At 19, she signed up for multiple credit cards and buy now, pay later schemes, viewing them as a source of “free money.” However, this financial recklessness led her into a daunting £12,500 debt.

Now a senior asset manager, Natalie began receiving letters from debt collectors as she struggled to pay her bills. To resolve her mounting charges, she took out a loan. But only after she met her now-husband, Lee, the 36-year-old decided to take control of her finances and break free from her debt.

Natalie admitted, “I was so embarrassed and stupid that I had allowed myself to get into such a state. I’m fairly intelligent, but I had lost control entirely regarding money. I had no understanding of lending whatsoever, and in the short-term, I felt like it was free money, especially as accessing it seemed so easy.”

She explained that many of her favourite high street shops readily offered her store cards, allowing her to indulge in monthly shopping sprees. The delayed payment aspect of these schemes made her feel like she was acquiring everything for free. Natalie recalled, “I’d have all the latest clothes, shoes, and bags, and it was brilliant.”

As time passed, Natalie relied on her overdraft and maxed out credit cards to maintain her lifestyle, which was unsustainable.

“I needed help and knew I was in such a bad place. I kept looking at my monthly wage slip and knowing there was no way I could afford to pay everything off,” she admitted.

Determined to regain control of her finances, Natalie took action. She cleared smaller debts by making sacrifices, such as staying in during weekends. For larger loans, she sought help from a debt management agency. She successfully eliminated her debt after five years of hard work and diligence. She felt a sense of relief and excitement about her newfound financial freedom.

Today, Natalie only owns two credit cards for emergencies and uses buy now, pay later schemes, like Klarna, for smaller purchases. While unexpected bills still pose challenges, she manages her finances effectively, thanks to budgeting and disciplined spending.

Natalie concluded, “If used properly, these schemes can be perfect, and I benefit from them now. There needs to be more education surrounding them, though, as I didn’t know anything about my credit score and how important this was. Speak to the lenders if you’re struggling, as they can help. Don’t suffer in silence – sweeping it under the carpet does nothing but allow the problem to get bigger until it ruins your life.”

Disclaimers:

This content and images have been licensed to use by Jam Press, edited and syndicated by https://www.znewsservice.com/.

Should you have any questions relating to this content please get in touch with Jam Press via https://www.jampress.co.uk/contact-us/