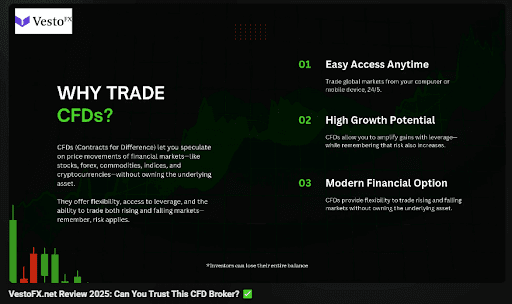

CFD trading, particularly when it comes to indices, has become increasingly popular among traders across the globe. As platforms like VestoFX.net offer access to a wide variety of financial instruments through Contracts for Difference (CFDs), it’s important for traders to fully understand both the risks and the rewards of this type of trading.

Whether you are an experienced trader or just starting, it’s crucial to grasp the dynamics involved in CFD trading, especially in indices, as it can be a complex yet rewarding market to navigate.

VestoFX.net Reviews: What Are Indices CFDs?

Before delving into the specific risks and rewards, it’s important to understand what indices CFDs are. An index is a statistical measure of the performance of a group of stocks that represent a particular sector or economy.

When trading indices via CFDs, traders speculate on the price movement of the underlying index, such as the S&P 500, the FTSE 100, or the NASDAQ. These indices reflect the combined performance of the stocks they represent, and trading CFDs on them allows traders to take advantage of their price movements without owning the actual stocks.

VestoFX.net reviews highlight how this type of trading provides an accessible way for traders from all corners of the world, including regions like the UAE, Singapore, and Kuwait, to engage with global markets without the need to purchase individual stocks.

With the ability to trade on both rising and falling markets, indices CFDs offer potential opportunities.

VestoFX.net Reviews: The Benefits of Trading Indices CFDs

Leverage Opportunities

One of the most attractive aspects of CFD trading is the ability to use leverage. Leverage allows traders to control a larger position in the market than their initial investment, amplifying potential gains.

For example, with a 10:1 leverage ratio, a trader can control a position worth $10,000 with only $1,000 of their own capital. However, it is important to note that while leverage increases the potential for profits, it also increases the risk of losses.

VestoFX.net suggests that, when used correctly, leverage can provide significant rewards. Indices are often seen as less volatile than individual stocks, and with the right leverage, traders can benefit from smaller price movements.

However, VestoFX.net emphasizes the importance of risk management when using leverage, as a significant loss can quickly deplete your trading account.

Diversification

Indices CFDs also offer the benefit of diversification. When you trade an index, you are essentially trading a basket of stocks. This reduces the individual risk of relying on one stock’s performance.

For example, the S&P 500 includes 500 companies from different sectors, which provides a natural hedge against sector-specific volatility.

VestoFX.net reviews the diversification benefit, particularly for traders who want to gain exposure to broader market movements without being tied to the performance of one individual stock.

Access to Global Markets

VestoFX.net suggests that one of the key benefits of trading indices CFDs is the ability to access markets all over the world. Whether you’re trading the European, American, or Asian markets, indices CFDs give traders a simple way to speculate on global economic conditions.

This provides exposure to market trends and sectors that are otherwise difficult to reach without a significant investment in foreign stocks.

VestoFX.net emphasizes that, as a platform, it offers traders access to a wide array of indices from major global markets. This flexibility allows traders to capitalize on opportunities wherever they arise, from stock market rallies in the U.S. to downturns in European indices.

VestoFX.net Reviews: The Risks of Trading Indices CFDs

While there are certainly rewards to be found in CFD trading, particularly in indices, traders must also consider the risks involved. It is important to have a clear understanding of these risks to approach trading with caution.

Volatility

Indices are often less volatile than individual stocks, but they can still experience significant price fluctuations, particularly during periods of economic uncertainty or geopolitical events. For instance, a global financial crisis, natural disasters, or political unrest can cause sudden and unpredictable movements in indices.

VestoFX.net suggests that traders should be aware of the volatility risks, especially during periods of heightened uncertainty. Understanding the market conditions and staying informed about global events is crucial for minimizing risk when trading indices CFDs.

Leverage Risks

While leverage can amplify profits, it can also magnify losses. If a trader is not careful, they can lose more than their initial investment. This is especially true in highly leveraged trades where small movements in the market can result in large losses.

VestoFX.net emphasizes that proper risk management strategies are essential when using leverage. This includes setting stop-loss orders, limiting the amount of capital risked on each trade, and ensuring that leverage is used in a controlled manner.

The platform advises that traders only use leverage with a full understanding of how it works and its potential consequences.

Market Risk

Indices are influenced by a variety of factors, including economic data, corporate earnings, and market sentiment. Negative news or reports related to the companies within the index can have a significant impact on the overall performance of the index, causing fluctuations that can result in losses for traders.

VestoFX.net reviews the importance of staying informed about global market trends and understanding the underlying factors that influence indices. Traders should conduct thorough research before making trades, as market sentiment can change rapidly.

VestoFX.net Reviews: How to Manage Risk When Trading Indices CFDs

Use Stop-Loss Orders

One of the most effective ways to manage risk in CFD trading is by using stop-loss orders. A stop-loss order automatically closes a position when the market moves against you by a certain amount, helping to limit losses.

VestoFX.net recommends that traders always use stop-loss orders, particularly when trading highly volatile indices.

Diversify Your Portfolio

As mentioned earlier, one of the key advantages of trading indices CFDs is the diversification they offer. VestoFX.net reviews how traders can further manage risk by diversifying their portfolios across different indices. This strategy helps to reduce the impact of losses from one market by balancing them with potential gains from others.

Stay Informed

Keeping up with global news and economic reports is crucial for successful CFD trading. Indices can be influenced by a wide range of factors, and being aware of the latest developments can give traders a competitive edge.

VestoFX.net suggests that traders regularly follow market trends, news, and reports that could impact their positions.

Conclusion

CFD trading in indices can be an exciting and potentially profitable venture, but it comes with its risks. VestoFX.net reviews how understanding the risks and rewards involved is crucial for successful trading.

By leveraging opportunities, diversifying portfolios, and employing sound risk management strategies, traders can navigate the complexities of indices CFD trading.

About VestoFX.net

VestoFX.net is operated by FAIRMONT FINANCIAL SERVICES (PTY) LTD, a South African investment firm, authorized and regulated by the Financial Sector Conduct Authority of South Africa with Financial Service Provider (FSP) license number 51766. The platform offers CFDs on a wide variety of assets, including stocks, crypto, commodities, indices, and currencies. With a user-friendly interface and access to global markets, VestoFX.net provides traders with the tools they need to engage in CFD trading with confidence. Whether you are interested in indices or other financial instruments, VestoFX.net offers a robust platform designed to cater to the needs of traders around the world.